Denied by the bank?

Need a Loan?

Our Team Of Mortgage Professionals Has Helped Thousands Of Homeowners Get Approved.

Your Brighter Financial Future Starts Here

Our Professional Team is Here to Help

A journey filled with five-star experiences at every stage.

We recognize that navigating the mortgage application process can feel daunting. That's why we are dedicated to ensuring you receive the utmost satisfaction with our services. Our aim is to alleviate the pressure from your application journey by offering unwavering support, addressing any inquiries you may have, and assisting you through every stage of the process.

Unparalleled knowledge and expertise in the industry.

Our team of experts, honoured with awards, boasts extensive experience handling even the most complex applications. With a wealth of industry expertise and innovative problem-solving skills, there's no challenge we haven't encountered. No matter how daunting you perceive your application to be, we're here to assist you in finding the ideal solution.

An Entire Professional Team, Working For You

When you apply with iMortgage Capital, you get an entire team of licensed mortgage professionals working to get your loan approved, not just one mortgage agent. This allows us to ensure you are fully taken care of every step of the way and provide you with the best possible solution for whatever it is that you are looking to accomplish!

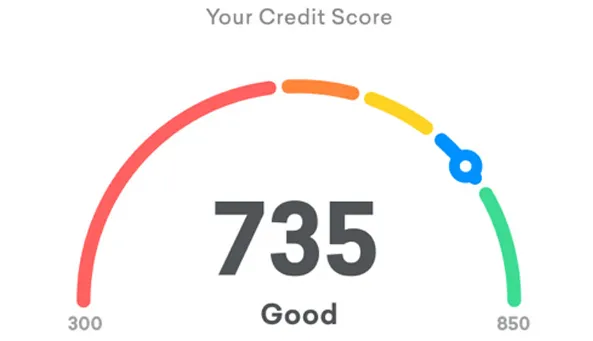

Boost Credit & Save More

Credit repair within 60 days

Once your loan is funded and debts are paid, you will see an increase in your credit rating within 2 months.

Public records to fall off

Your paid collection items, judgements, and consumer proposals will also begin to update.

Qualify for better products

As your overall borrower profile improves, you will quality for better products and save more.

How to Get Started

Step 1

Call us or apply online

Take a few minutes to talk to one of our Specialists to help us understand what you’re looking to accomplish.

Step 2

Follow our proven process

Follow our proven Customer Success Journey which allows us to align your goals with the best solution for you.

Step 3

Receive your funds

Once your paperwork is signed, receive your funds in as little as two business days.

Solutions

At iMortgage Capital, we provide mortgage solutions that help homeowners to take advantage of their home’s equity and invest in their future. We help our clients weigh different lending options to help them identify the one that will best suit their needs. Our goal is to give our clients an unmatched borrowing experience with a personalized level of care. We put our client’s interests above and beyond everything else.

We operate with a high level of professionalism and compassion to ensure every client feels like part of our community, not just another application. As a premier mortgage brokerage in Ontario, we are invested in our clients’ needs, questions, and concerns. We work with homeowners all over the province. Learn what we can do for you today.

Home Equity Line of Credit

Home equity loans allow you to access your property’s equity in a single, convenient payment. Borrowers often use these funds to consolidate debt or pay for significant expenses such as education costs, vehicle repairs, or home renovations.

Home Equity Loans

Home equity loans allow you to access your property’s equity in a single, convenient payment. Borrowers often use these funds to consolidate debt or pay for significant expenses such as education costs, vehicle repairs, or home renovations.

2nd Mortgages

With a second mortgage, you can borrow additional funds against your home’s equity without the strict lending criteria of a traditional bank as credit and income. This type of loan is typically used to solidify outstanding debts or cover renovation costs within the home.

Debt Consolidation

A debt consolidation mortgage allows you to consolidate multiple debts into a single, low monthly payment. Through this method, you can often reduce your monthly payments by up to 75%.

Stop Power Of Sale

Stopping a power of sale will help you maintain control of your property. It allows you to catch up on outstanding debts or pay out your existing lender before they take possession of your property and sell it.

Bridge Financing

A bridge loan allows you to access the equity of a sold property to purchase your next piece of real estate without waiting for the closing date.

Mortgage Refinancing

Refinancing your mortgage can help you lower your current interest rate, access your equity immediately, or combine multiple mortgages and debts into one lump sum. Refinancing ultimately allows you to replace your existing loan with a revised one.

Private Mortgage

Stopping a power of sale will help you maintain control of your property. It allows you to catch up on outstanding debts or pay out your existing lender before they take possession of your property and sell it.

Purchase Property

A bridge loan allows you to access the equity of a sold property to purchase your next piece of real estate without waiting for the closing date.

Reverse Mortgage

Reverse Mortgages allow borrowers to leverage their home’s equity for a more comfortable retirement. Unlike traditional loans, a Reverse Mortgage provides you with a steady stream of income or a lump sum, empowering you to enjoy the fruits of your homeownership without the burden of monthly payments. Borrowers can use the funds for things like travel, healthcare, or enhancing your overall quality of life.

Rent-To-Own

Rent-To-Own financing is a pathway to homeownership where borrowers lease a property with the option to buy. This innovative approach offers aspiring homeowners the chance to live in their dream home while building towards ownership. Rent-To-Own financing provides a dynamic solution for those seeking financial flexibility and a clear path to making a house a home.

Construction Financing

Construction Financing is a specialized financing that enables borrowers to progress from blueprint to project completion, offering the financial support needed for construction projects. Structured differently than traditional financing to align with the specific requirements and timelines of a construction project.

Tailored mortgage solutions available at your fingertips.

Our trusted team genuinely cares about your best interests. We work hard to provide you with short and long-term solutions that will help improve your financial health so you can focus on what matters most.

Frequently Asked Questions

1. Why use a Mortgage Broker?

Mortgage brokers are licensed financial professionals that have the resources to find the lowest rates and the appropriate payment plans for their clients. Working with a broker will save you time and ensure you get the best possible deal.

2. What does a Mortgage Broker do for you?

A mortgage broker acts as the middleman between you and the extensive paperwork involved on your behalf for a set fee. They are often able to foresee problems that could arise during the application process and tailor your application based on what each lender needs.The role of a mortgage broker is to act as a connection between the borrower and the lender to secure a loan on behalf of the individual or their business. Their responsibilities include negotiating rates, dealing with the paperwork, and facilitating an agreed-upon loan and payment plan.

One of the most significant benefits of working with a broker is their extensive network, as they have the tools and resources to identify and obtain the loan that will fit your needs.

3. How does a Mortgage Broker work?

A mortgage broker compiles a homeowner’s financial documents, accesses their credit history, and confirms current and past employment to present an application to multiple lenders. They help negotiate the terms and conditions of your payment plan and, once the loan is agreed, will work with the lender to ensure a smooth and efficient transaction.

4. What are Mortgage Broker fees in Ontario?

Mortgage broker fees in Ontario vary based on your unique situation and the solution you are seeking. Contact us today for a more personalized estimate of what you can expect your fees to be.

5. Why iMortgage Capital?

Owning a home is an investment that deserves detailed attention and care. When unexpected expenses occur, or you need to consolidate your debts, it’s essential to find the right broker to step in and offer a solution tailored to your financial needs. We operate with a vast network of lenders, including subprime mortgage lenders across the province, and we’ll work diligently to find the right match for our clients. At iMortgage Capital, our mission is to give homeowners across Ontario the best possible borrowing experience through a high level of service and expertise. When you work with us, you’re working with a Professional team that specializes in getting even the toughest of applications approved. We’re putting money in your pocket faster, so you can invest in your future.

6. What locations does iMortgage Capital serve?

iMortgage Capital offers mortgage broker services, with a specialty in subprime mortgages, across the province of Ontario.

7. What is the iMortgage Capital approach?

At iMortgage Capital, we know that each homeowner’s experience is unique. We offer a personalized approach and help connect our clients with subprime lending options across Ontario. From day one, we treat each interaction with our clients as a chance to change their borrowing experience to a positive one.

We take the time to understand what our clients are looking to accomplish with their applications. We personalize short-term and long-term solutions to help our clients achieve long-term financial health. We look at our client’s main priorities to make sure we shape the optimal payment amounts, term length, prepayment privileges, interest rates, and much more. We know how important it is to align our clients with reasonable rates and terms and educate them on areas like an exit strategy to make sure they are always on the right path.

8. Who can iMortgage Capital connect me with?

As an industry-leading Mortgage Brokerage, we leverage our vast network of banks, institutions, MICs, private lenders, and investors to connect our clients with some of the best lending options.

9. Who can work with iMortgage Capital?

Even if your credit score is below 650, our vast lending network allows us to deliver approvals for even the most complex applications. We believe every homeowner deserves to make the most of their home’s equity. We negotiate on your behalf and shop your application to multiple lenders to get you the most competitive rates and terms.

10. What Timeline can I expect?

With our quick turnaround times, we can put money in your pocket in as little as 48 hours. Our goal is to deliver the best possible results for our clients and deliver them fast!

Communities We Serve

We provide service throughout all of Ontario with a focus on the following cities:

Ajax

Barrie

Brampton

Burlington

Caledon

Cambridge

Greater Sudbury

Guelph

Hamilton

Kingston

Kitchener

London

North Bay

Oshawa

Ottawa

Ajax

Barrie

Brampton

Burlington

Caledon

Thunder Bay

Toronto

Waterloo

Whitby

Windsor

Contact Us Today

Reviews

Subscribe to our newsletter

Join our newsletter to receive the latest industry news, updates and insights from our team at iMortgage Capital.

Facebook

Instagram

Youtube